1 Executive Summary

This report presents the results of our engagement with Flexa to review Amp Token and Flexa Collateral Manager. Flexa is a payment network, using smart contract and Amp collateral to facilitate off-chain payments.

The review was conducted over the course of two weeks, from June 9, 2020 to June 19, 2020 by Shayan Eskandari and Valentin Wüstholz. A total of 15 person-days were spent.

The review of the initial report fixes were performed from August 10, 2020 to August 14, 2020 by Shayan Eskandari.

2 Scope

Our review focused on the commit hash 4203e96d1138632a991d072d0c232fd8ba69c9e1 for amp-contracts, and 4203e96d1138632a991d072d0c232fd8ba69c9e1 for flexa-collateral-manager. The list of files in scope can be found in the Appendix.

Update: The final review of the initial report fixes were done on the commit hash aece0f6b24df6348221da548a815528a6633a20e for amp-token-contracts, and 8d421c295c2ed5d3eef12e5992d96efb8d10d2d3 for flexa-collateral-manager.

2.1 Objectives

Together with the the Flexa team, we identified the following priorities for our review:

- Ensure that the system is implemented consistently with the intended functionality, and without unintended edge cases.

- Identify known vulnerabilities particular to smart contract systems, as outlined in our Smart Contract Best Practices, and the Smart Contract Weakness Classification Registry.

The second review was mainly a check for the fixes of the issues filed in the initial report. The rest of the text in this report reflects the initial review unless explicitly tagged as Update.

3 System Overview

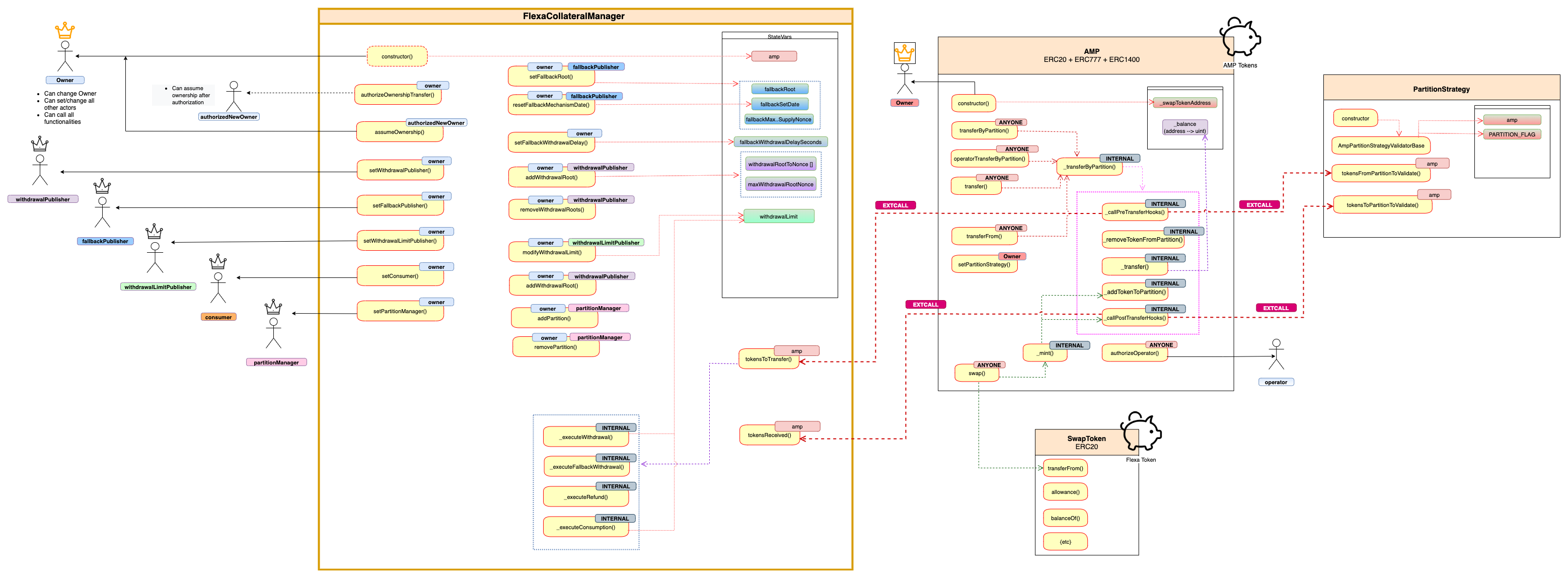

The following figure is a visualization of the actors and the overview of Flexa Collateral Manager with Amp Token:

Many of the internal calls to view/pure functions and details regarding partitions are removed from this chart for more readability.

The Actors and their permissions in the system are described in Security specification section.

4 Security Specification

This section describes, from a security perspective, the expected behavior of the system under audit. It is not a substitute for documentation. The purpose of this section is to identify specific security properties that were validated by the audit team.

4.1 Actors

The relevant actors are listed below with their respective abilities:

Flexa Collateral Manager

-

owner

- Can change ownership

- Can set and change all other actors in the system at any time

- Can call all functionalities that other actors can call

- Can update the delay period (time-lock) in which fallback mechanism is activated (

fallbackWithdrawalDelaySeconds)

-

withdrawalPublisher

- Can add Merkle Root for authorized token withdrawals

- Note that the root is not verified and can be an invalid value. Also the call to add root will remove the specified previous withdrawal roots in the smart contract.

- Can remove any of the previously added roots in the smart contract

- Can add Merkle Root for authorized token withdrawals

-

fallbackPublisher

- Can set Fallback Merkle Root, which will update the fallback SetDate, MaxIncludedSupplyNonce and the root itself.

- Note that the root is not verified and can be an invalid value.

- Can reset fallback mechanism date, resulting in delay in fallback period without publishing new root, or to deactivate the fallback mechanism temporarily

- Can set Fallback Merkle Root, which will update the fallback SetDate, MaxIncludedSupplyNonce and the root itself.

-

withdrawalLimitPublisher

- Can modify the global withdrawal limit

- Note: setting this limit to 0, disables all withdrawals and breaks the executions (e.g.

_executeWithdrawal,_executeConsumption) - The value of

withdrawalLimitalso is decreased after every consumer execution

- Note: setting this limit to 0, disables all withdrawals and breaks the executions (e.g.

- Can modify the global withdrawal limit

-

consumer

- Can execute consumption (consumption transfers)

- Note that consumer is trusted, as in if consumer executes a transfer, he can spend up to

withdrawalLimitwhich then all withdrawals will be impossible until withdrawalLimitPublisher modifies the withdrawalLimit to a number other than 0 to re-enable withdrawals.

- Note that consumer is trusted, as in if consumer executes a transfer, he can spend up to

- Can execute consumption (consumption transfers)

-

partitionManager

- Can add & remove new partitions to the system

- Removed partition will be disallowed from incoming transfers

- Can add & remove new partitions to the system

All the above actors in this system are trusted in this system, meaning that they could misbehave and temporarily block other functionalities of the system, however they all can be replaced by owner as well.

Update: consumer was renamed to directTransferer to remove confusion. All associated actions were also renamed, such as consume –> directTransfer and so on.

Amp Token

-

owner

- Can set partition strategy addresses, linking PartitionStrategy contracts to specific prefixes in the system

-

operator

- Anyone can authorize an Operator for all their token balance or a specific partition.

- Can transfer from user’s balance (or the partition the operator is authorized for)

- Any token holder is also his own operator

4.2 Important Security Properties & Trust Model

In any system, it’s important to identify what trust is expected/required between various actors. For this audit, we established the following trust model:

- Flexa (Actors in the system) are trusted, they can misbehave and update the contract in a way that the withdrawals are blocked.

- The Merkle Tree Roots published on the smart contract can be removed/replaced by the publisher actor, making the valid withdrawals invalid. However the premise is that the publisher will act honestly and is part of the system.

- There are some concerns about external call in Amp.Swap() regarding reentrancy or other malicious token implementations, however as swapToken here is previously deployed Flexa ERC20 token, we assume the token is trusted and does not have malicious intentions.

- It should be noted that ERC777 introduces the hooks that have been used for reentrancy attack vectors in other DApps that have interacted with the ERC777 smart contract.

- Partition Strategies are set by the Amp owner and we assume they are trusted, as there are external calls to the functions defined in these contracts.

5 Issues

Each issue has an assigned severity:

- Minor issues are subjective in nature. They are typically suggestions around best practices or readability. Code maintainers should use their own judgment as to whether to address such issues.

- Medium issues are objective in nature but are not security vulnerabilities. These should be addressed unless there is a clear reason not to.

- Major issues are security vulnerabilities that may not be directly exploitable or may require certain conditions in order to be exploited. All major issues should be addressed.

- Critical issues are directly exploitable security vulnerabilities that need to be fixed.

5.1 Eliminate assembly code by using ABI decode Major ✓ Fixed

Resolution

abi.decode().

Description

There are several locations where assembly code is used to access and decode byte arrays (including uses inside loops). Even though assembly code was used for gas optimization, it reduces the readability (and future updatability) of the code.

Examples

code/amp-contracts/contracts/partitions/PartitionsBase.sol:L39-L44

assembly {

flag := mload(add(_data, 32))

}

if (flag == CHANGE_PARTITION_FLAG) {

assembly {

toPartition := mload(add(_data, 64))

code/amp-contracts/contracts/partitions/PartitionsBase.sol:L43-L44

assembly {

toPartition := mload(add(_data, 64))

Same code as above is also present here:

/flexa-collateral-manager/contracts/FlexaCollateralManager.sol#L1403

flexa-collateral-manager/contracts/FlexaCollateralManager.sol#L1407

code/flexa-collateral-manager/contracts/FlexaCollateralManager.sol:L1463-L1470

for (uint256 i = 116; i <= _operatorData.length; i = i + 32) {

bytes32 temp;

assembly {

temp := mload(add(_operatorData, i))

}

proof[index] = temp;

index++;

}

Recommendation

As discussed in the mid-audit meeting, it is a good solution to use ABI decode since all uses of assembly simply access 32-byte chunks of data from user input. This should eliminate all assembly code and make the code significantly more clean. In addition, it might allow for more compact encoding in some cases (for instance, by eliminating or reducing the size of the flags).

This suggestion can be also applied to Merkle Root verifications/calculation code, which can reduce the for loops and complexity of these functions.

5.2 Ignored return value for transferFrom call Major ✓ Fixed

Resolution

require to validate the success/failure of transferFrom().

Description

When burning swap tokens the return value of the transferFrom call is ignored. Depending on the token’s implementation this could allow an attacker to mint an arbitrary amount of Amp tokens.

Note that the severity of this issue could have been Critical if Flexa token was any arbitrarily tokens. We quickly verified that Flexa token implementation would revert if the amount exceeds the allowance, however it might not be the case for other token implementations.

code/amp-contracts/contracts/Amp.sol:L619-L620

swapToken.transferFrom(_from, swapTokenGraveyard, amount);

Recommendation

The code should be changed like this:

require(swapToken.transferFrom(_from, swapTokenGraveyard, amount));

5.3 No integration tests for the two main components Medium ✓ Fixed

Resolution

amp-contractsadded as a submodule tocollateral-managerand full integration tests added

It is recommended to write test suites that achieve high code coverage to prevent missing obvious bugs that tests could cover.

Description

The existing tests cover each of the two main components and each set of tests mocks the other component. While this is good for unit testing some issues might be missed without proper system/integration tests that cover all components.

Recommendation

Consider adding system/integration tests for all components. As we’ve seen in the recent issues in multi-contract smart contract systems, it’s becoming more crucial to have a full test suits for future changes to the code base. Not having inter-component tests, could result in issues in the next development and deployment cycles.

5.4 Potentially insufficient validation for operator transfers Medium ✓ Fixed

Resolution

removing operatorTransferByPartition and simplifying the interfaces to only tranferByPartition

This removes the existing tranferByPartition, converting operatorTransferByPartition to it. The reason for this is to make the client interface simpler, where there is one method to transfer by partition, and that method can be called by either a sender wanting to transfer from their own address, or an operator wanting to transfer from a different token holder address. We found that it was redundant to have multiple methods, and the client convenience wasn’t worth the confusion.

Description

For operator transfers, the current validation does not require the sender to be an operator (as long as the transferred value does not exceed the allowance):

code/amp-contracts/contracts/Amp.sol:L755-L759

require(

_isOperatorForPartition(_partition, msg.sender, _from) ||

(_value <= _allowedByPartition[_partition][_from][msg.sender]),

EC_53_INSUFFICIENT_ALLOWANCE

);

It is unclear if this is the intention or whether the logical or should be a logical and.

Recommendation

Confirm that the code matches the intention. If so, consider documenting the behavior (for instance, by changing the name of function operatorTransferByPartition.

5.5 Potentially missing nonce check Medium Acknowledged

Resolution

Nothing was done here, as Dave M writes:

The first two are working as intended, and the third does check that the value is monotonically increasing.

Description

When executing withdrawals in the collateral manager the per-address withdrawal nonce is simply updated without checking that the new nonce is one greater than the previous one (see Examples). It seems like without such a check it might be easy to make mistakes and causing issues with ordering of withdrawals.

Examples

code/flexa-collateral-manager/contracts/FlexaCollateralManager.sol:L663-L664

addressToWithdrawalNonce[_partition][supplier] = withdrawalRootNonce;

code/flexa-collateral-manager/contracts/FlexaCollateralManager.sol:L845-L846

addressToWithdrawalNonce[_partition][supplier] = maxWithdrawalRootNonce;

code/flexa-collateral-manager/contracts/FlexaCollateralManager.sol:L1155-L1156

maxWithdrawalRootNonce = _nonce;

Recommendation

Consider adding more validation and sanity checks for nonces on per-address withdrawals.

5.6 Unbounded loop when validating Merkle proofs Medium ✓ Fixed

Resolution

abi.decode.

Description

It seems like the loop for validating Merkle proofs is unbounded. If possible it would be good to have an upper bound to prevent DoS-like attacks. It seems like the depth of the tree, and thus, the length of the proof could be bounded.

This could also simplify the decoding and make it more robust. For instance, in _decodeWithdrawalOperatorData it is unclear what happens if the data length is not a multiple of 32.

It seems like it might result in out-of-bound reads.

code/flexa-collateral-manager/contracts/FlexaCollateralManager.sol:L1460-L1470

uint256 proofNb = (_operatorData.length - 84) / 32;

bytes32[] memory proof = new bytes32[](proofNb);

uint256 index = 0;

for (uint256 i = 116; i <= _operatorData.length; i = i + 32) {

bytes32 temp;

assembly {

temp := mload(add(_operatorData, i))

}

proof[index] = temp;

index++;

}

Recommendation

Consider enforcing a bound on the length of Merkle proofs.

Also note that if similar mitigation method as issue 5.1 is used, this method can be replaced by a simpler function using ABI Decode, which does not have any unbounded issues as the sizes of the hashes are fixed (or can be indicated in the passed objects)

5.7 Mitigation for possible reentrancy in token transfers Medium ✓ Fixed

Resolution

Description

ERC777 adds significant features to the token implementation, however there are some known risks associated with this token, such as possible reentrancy attack vector. Given that the Amp token uses hooks to communicate to Collateral manager, it seems that the environment is trusted and safe. However, a minor modification to the implementation can result in safer implementation of the token transfer.

Examples

In Amp.sol --> _transferByPartition()

code/amp-contracts/contracts/Amp.sol:L1152-L1177

require(

_balanceOfByPartition[_from][_fromPartition] >= _value,

EC_52_INSUFFICIENT_BALANCE

);

bytes32 toPartition = _fromPartition;

if (_data.length >= 64) {

toPartition = _getDestinationPartition(_fromPartition, _data);

}

_callPreTransferHooks(

_fromPartition,

_operator,

_from,

_to,

_value,

_data,

_operatorData

);

_removeTokenFromPartition(_from, _fromPartition, _value);

_transfer(_from, _to, _value);

_addTokenToPartition(_to, toPartition, _value);

_callPostTransferHooks(

toPartition,

Recommendation

It is suggested to move any condition check that is checking the balance to after the external call. However _callPostTransferHooks needs to be called after the state changes, so the suggested mitigation here is to move the require at line 1152 to after _callPreTransferHooks() function (e.g. line 1171).

5.8 Potentially inconsistent input validation Medium ✓ Fixed

Resolution

transferWithData was removed as a resolution of another filed issue, the rest are documented properly.

The

msg.sendercannot be authorized or revoked from being an operator for itself. This should also be clear from the natspec comments now.

Description

There are some functions that might require additional input validation (similar to other functions):

Examples

Amp.transferWithData:require(_isOperator(msg.sender, _from), EC_58_INVALID_OPERATOR);like in

code/amp-contracts/contracts/Amp.sol:L699

require(_isOperator(msg.sender, _from), EC_58_INVALID_OPERATOR);

Amp.authorizeOperatorByPartition:require(_operator != msg.sender);like in

code/amp-contracts/contracts/Amp.sol:L789

require(_operator != msg.sender);

Amp.revokeOperatorByPartition:require(_operator != msg.sender);like in

code/amp-contracts/contracts/Amp.sol:L800

require(_operator != msg.sender);

Recommendation

Consider adding additional input validation.

5.9 ERC20 compatibility of Amp token using defaultPartition Medium ✓ Fixed

Resolution

This fix resulted in significant changes to the token allowance work flow. The new implementation of balanceOf represents the total balance of tokens at that address (across any partition), instead of only default partition.

The approve + allowance based operations were using a distinct global allowance mapping, while the rest of the ERC20 compat operations were using the partition state mappings with the default partition. This makes the allowance operations behave the same as the balance based operations.

Description

It is somewhat unclear how the Amp token ensures ERC20 compatibility. While the default partition is used in some places (for instance, in function balanceOf) there are also separate fields for (aggregated) balances/allowances. This seems to introduce some redundancy and raises certain questions about when which fields are relevant.

Examples

-

_allowedis used in functionallowanceinstead of_allowedByPartitionwith the default partition -

An

Approvalevent should be emitted when approving the default partition

code/amp-contracts/contracts/Amp.sol:L1494

emit ApprovalByPartition(_partition, _tokenHolder, _spender, _amount);

increaseAllowance()vs.increaseAllowanceByPartition()

Recommendation

After the mid-audit discussion, it was clear that the general balanceOf method (with no partition) is not needed and can be replaced with a balanceOf function that returns balance of the default partition, similarly for allowance, the general increaseAllowance function can simply call increaseAllowanceByPartition using default partition (same for decreaseAllowance).

5.10 Duplicate code better be moved to shared library Minor ✓ Fixed

Resolution

PartitionUtils.sol, which also fixed the inconsistency in function implementations.

Description

There are some functionalities that the code is duplicated between different smart contracts.

Examples

_getDestinationPartition()is present in bothPartitionBase.solandFlexaCollateralManager.sol- Note that in

PartitionBasethe usage results in dead code in the contract.

- Note that in

code/amp-contracts/contracts/Amp.sol:L1158-L1160

if (_data.length >= 64) {

toPartition = _getDestinationPartition(_fromPartition, _data);

}

code/amp-contracts/contracts/partitions/PartitionsBase.sol:L33-L36

toPartition = _fromPartition;

if (_data.length < 64) {

return toPartition;

}

_splitPartition()is present inFlexaCollateralManager.sol,PartitionBase.solwith slightly different implementations. One has an extra return value forsubPartitionwhich is not used in the code under audit

Recommendation

Use a shared library for these functions, possibly ParitionBased.sol can be used in Collateral Manager.

5.11 Additional validation for canReceive Minor ✓ Fixed

Resolution

_canReceive() with canReceive().

Description

For FlexaCollateralManager.tokensReceived there is validation to ensure that only the Amp calls the function. In contrast, there is no such validation for canReceive and it is unclear if this is the intention.

Examples

code/flexa-collateral-manager/contracts/FlexaCollateralManager.sol:L492-L493

require(msg.sender == amp, "Invalid sender");

Recommendation

Consider adding a conjunct msg.sender == amp in function _canReceive.

code/flexa-collateral-manager/contracts/FlexaCollateralManager.sol:L468-L470

function _canReceive(address _to, bytes32 _destinationPartition) internal view returns (bool) {

return _to == address(this) && partitions[_destinationPartition];

}

5.12 Update to Solidity 0.6.10 Minor ✓ Fixed

Resolution

0.6.10.

Description

Due to an issue found in 0.6.9, it is recommended to update the compiler version to latest version 0.6.10.

5.13 Discrepancy between code and comments Minor ✓ Fixed

Description

There are some discrepancies between (uncommented) code and the documentations comment:

Examples

code/amp-contracts/contracts/Amp.sol:L459-L462

// Indicate token verifies Amp, ERC777 and ERC20 interfaces

ERC1820Implementer._setInterface(AMP_INTERFACE_NAME);

ERC1820Implementer._setInterface(ERC20_INTERFACE_NAME);

// ERC1820Implementer._setInterface(ERC777_INTERFACE_NAME);

code/flexa-collateral-manager/contracts/FlexaCollateralManager.sol:L268-L279

/**

* @notice Indicates a supply refund was executed

* @param supplier Address whose refund authorization was executed

* @param partition Partition from which the tokens were transferred

* @param amount Amount of tokens transferred

*/

event SupplyRefund(

address indexed supplier,

bytes32 indexed partition,

uint256 amount,

uint256 indexed nonce

);

Recommendation

Consider updating either the code or the comment.

5.14 Several fields could potentially be private Minor Acknowledged

Resolution

: Comment from Flexa team:

We audited the suggested fields, and determined that we would like them to be public for transparency and/or functionality reasons.

Description

Several fields in Amp could possibly be private:

Examples

swapToken:

code/amp-contracts/contracts/Amp.sol:L261

ISwapToken public swapToken;

swapTokenGraveyard:

code/amp-contracts/contracts/Amp.sol:L268

address public constant swapTokenGraveyard = 0x000000000000000000000000000000000000dEaD;

collateralManagers:

code/amp-contracts/contracts/Amp.sol:L236

address[] public collateralManagers;

partitionStrategies:

code/amp-contracts/contracts/Amp.sol:L248

bytes4[] public partitionStrategies;

The same hold for several fields in FlexaCollateralManager. For instance:

partitions:

code/flexa-collateral-manager/contracts/FlexaCollateralManager.sol:L78

mapping(bytes32 => bool) public partitions;

nonceToSupply:

code/flexa-collateral-manager/contracts/FlexaCollateralManager.sol:L144

mapping(uint256 => Supply) public nonceToSupply;

withdrawalRootToNonce:

code/flexa-collateral-manager/contracts/FlexaCollateralManager.sol:L163

mapping(bytes32 => uint256) public withdrawalRootToNonce;

Recommendation

Double-check that you really want to expose those fields.

5.15 Several fields could be declared immutable Minor Acknowledged

Resolution

Comment from Flexa team:

We tried to add this, but found that it made validating the contract on Etherscan impossible. We have added comments to a reader of the contract indicating the fields are immutable after deployment, though.

Description

Several fields could be declared immutable to make clear that they never change after construction:

Examples

Amp._name:

code/amp-contracts/contracts/Amp.sol:L129

string internal _name;

Amp._symbol:

code/amp-contracts/contracts/Amp.sol:L134

string internal _symbol;

Amp.swapToken:

code/amp-contracts/contracts/Amp.sol:L261

ISwapToken public swapToken;

FlexaCollateralManager.amp:

code/flexa-collateral-manager/contracts/FlexaCollateralManager.sol:L73

address public amp;

Recommendation

Use the immutable annotation in Solidity (see Immutable).

Appendix 1 - Artifacts

This section contains some of the artifacts generated during our review by automated tools, the test suite, etc. If any issues or recommendations were identified by the output presented here, they have been addressed in the appropriate section above.

A.1.1 Harvey

As part of the audit, we performed several fuzzing campaigns using Harvey, our in-house greybox fuzzer for smart contracts, to check 8 custom properties. In order to fuzz the entire contract system, we used Flexa’s existing deployment scripts to set up an initial state for the fuzzer containing the following contracts:

- Amp

- FlexaCollateralManager

- ERC1820Registry

- MockFXC

- HolderCollateralPartitionValidator

- CollateralPoolPartitionValidator

We extended the deployment scripts to distribute MockFXC tokens to several known users such that they could interact with the system after approving the Amp contract. We also made a small number of changes to the code to improve the effectiveness of the fuzzer. Our final 24-hour fuzzing campaign was able to detect 3 property violations that were reviewed as part of the audit.

Note that—to support the auditor—several properties check if certain (not necessarily bad/dangerous) states are feasible and violations do not necessarily indicate issues with the code.

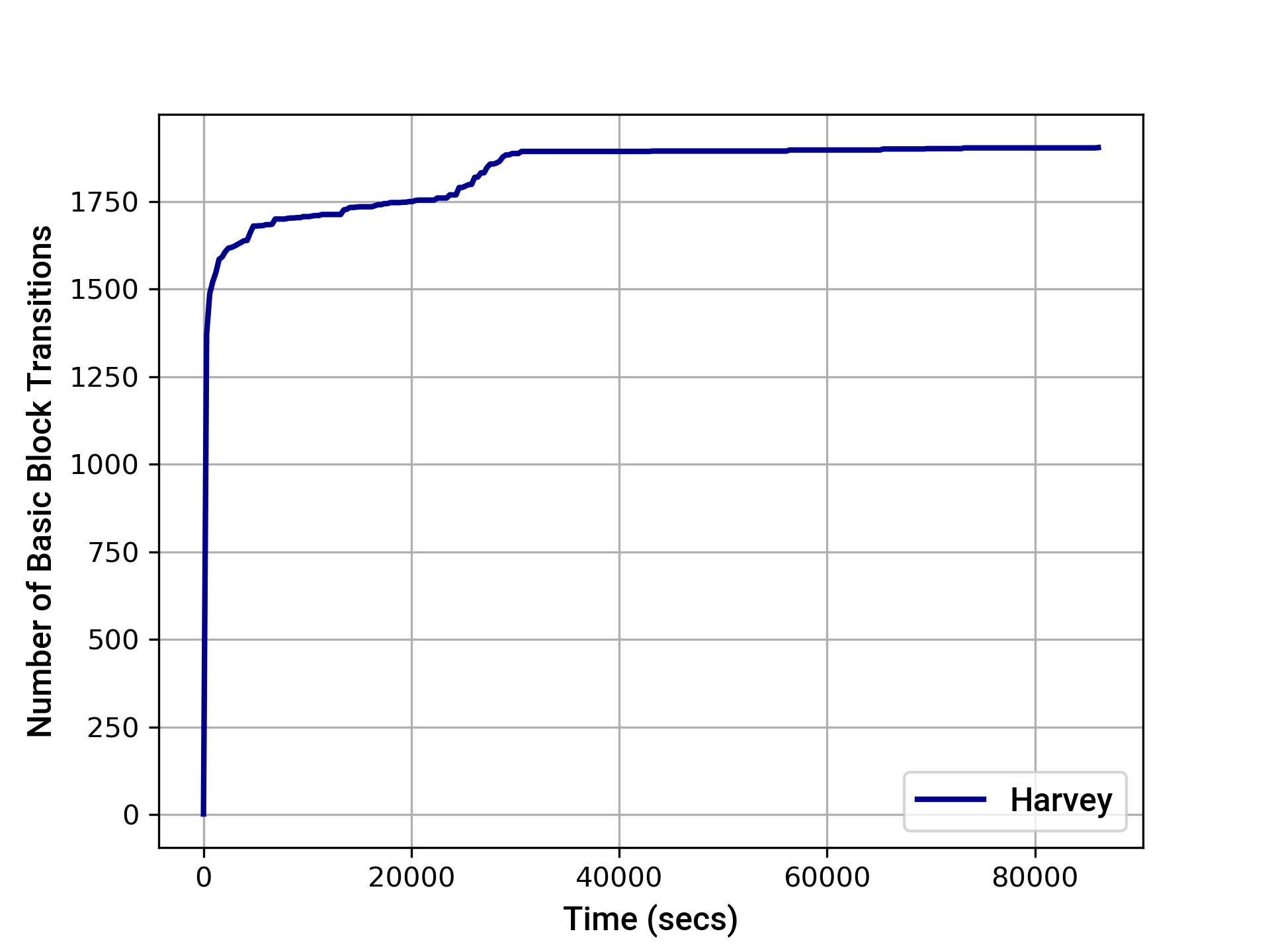

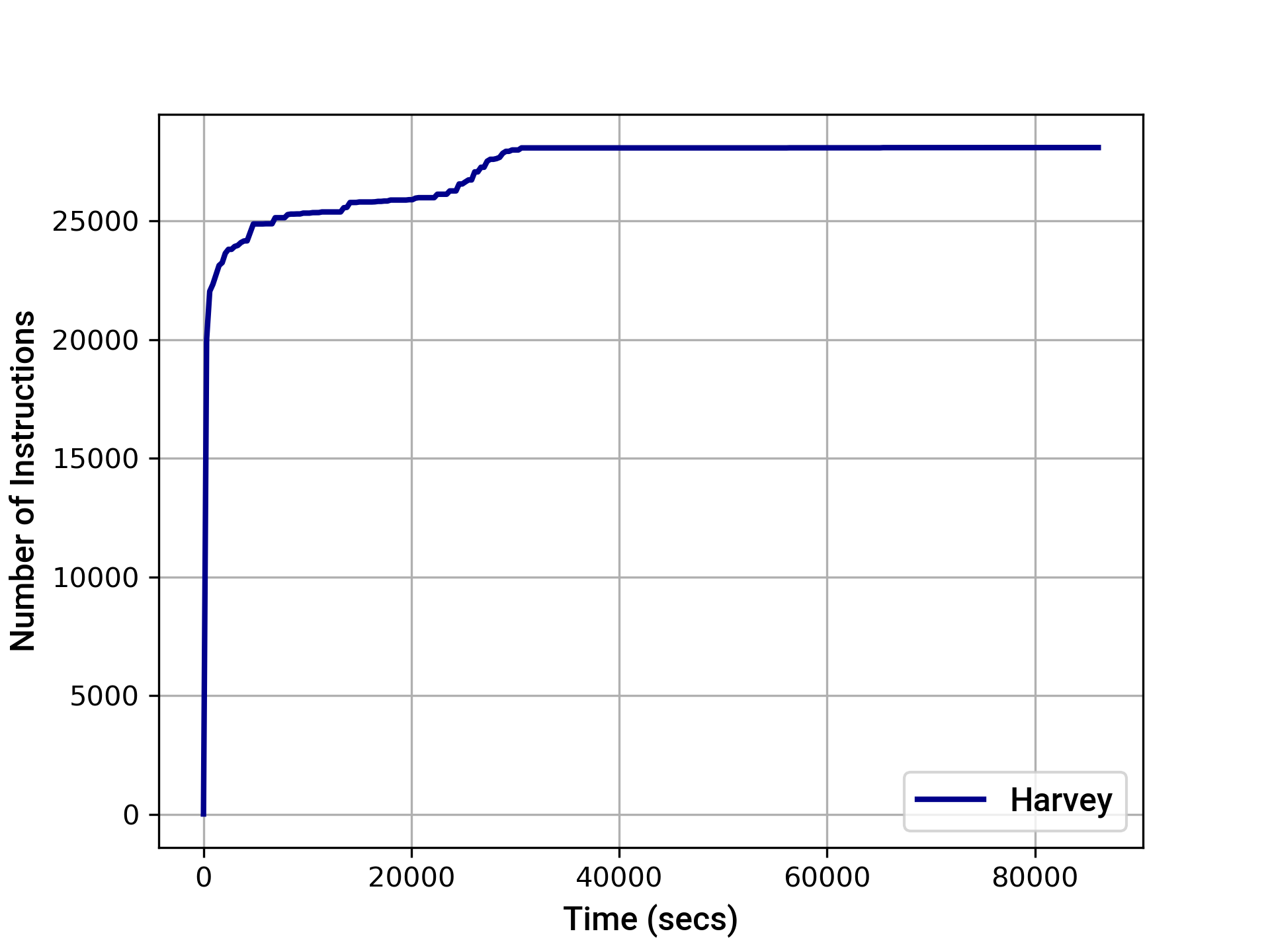

The graphs below provide an indication of the instruction and basic block transition coverage achieved by Harvey over time. After 24 hours, Harvey achieved the following coverage:

- EVM instruction coverage: 28090

- Path coverage: 7747

- EVM basic block transition coverage: 1904

A.1.2 Tests Coverage

Below is the coverage output generated by running the test suite:

It’s important to note that “100% test coverage” is not a silver bullet. Our review also included a inspection of the test suite to ensure that testing included important edge cases.

Appendix 2 - Files in Scope

This audit covered the following files:

| File | SHA-1 hash |

|---|---|

| flexa-collateral-manager/contracts/FlexaCollateralManager.sol | 416586f57559b9c673ebde06121f314d9f781c42 |

| flexa-collateral-manager/contracts/amp/IAmp.sol | cf5b55544a4aa60e86461e5f59b067218e1b5e1f |

| flexa-collateral-manager/contracts/amp/IAmpTokensRecipient.sol | bc6989130031ab842d44b07fb4869631743f86f8 |

| flexa-collateral-manager/contracts/amp/IAmpTokensSender.sol | 87c1435d51fbb6ab35a63adb7f9d89432edfe724 |

| flexa-collateral-manager/contracts/erc1820/ERC1820Client.sol | 0efb9dca16afe6da2b8b4b25408b985e1ef289b0 |

| amp-contracts/contracts/Amp.sol | d7c402dcdfb9edf88d7cec739932d1f6c2259437 |

| flexa-collateral-manager/contracts/FlexaCollateralManager.sol | 416586f57559b9c673ebde06121f314d9f781c42 |

| flexa-collateral-manager/contracts/amp/IAmp.sol | cf5b55544a4aa60e86461e5f59b067218e1b5e1f |

| flexa-collateral-manager/contracts/amp/IAmpTokensRecipient.sol | bc6989130031ab842d44b07fb4869631743f86f8 |

| flexa-collateral-manager/contracts/amp/IAmpTokensSender.sol | 87c1435d51fbb6ab35a63adb7f9d89432edfe724 |

| flexa-collateral-manager/contracts/erc1820/ERC1820Client.sol | 0efb9dca16afe6da2b8b4b25408b985e1ef289b0 |

| amp-contracts/contracts/erc1820/ERC1820Client.sol | e99262a96ee7e3d055055cfffe4168e8497ce2b0 |

| amp-contracts/contracts/erc1820/ERC1820Implementer.sol | b82a2caee3db82521bcf3d84412441db9d1c139a |

| amp-contracts/contracts/partitions/IAmpPartitionStrategyValidator.sol | 6e55bfed60d5175b9adef6aaa33822c3c078ee93 |

| amp-contracts/contracts/partitions/PartitionsBase.sol | 12b764eac1f6f5059d201a08a049c03989127538 |

| amp-contracts/contracts/codes/ErrorCodes.sol | f6e6c7dcc9dff16ec98086ab82684650cc886100 |

Appendix 3 - Disclosure

ConsenSys Diligence (“CD”) typically receives compensation from one or more clients (the “Clients”) for performing the analysis contained in these reports (the “Reports”). The Reports may be distributed through other means, including via ConsenSys publications and other distributions.

The Reports are not an endorsement or indictment of any particular project or team, and the Reports do not guarantee the security of any particular project. This Report does not consider, and should not be interpreted as considering or having any bearing on, the potential economics of a token, token sale or any other product, service or other asset. Cryptographic tokens are emergent technologies and carry with them high levels of technical risk and uncertainty. No Report provides any warranty or representation to any Third-Party in any respect, including regarding the bugfree nature of code, the business model or proprietors of any such business model, and the legal compliance of any such business. No third party should rely on the Reports in any way, including for the purpose of making any decisions to buy or sell any token, product, service or other asset. Specifically, for the avoidance of doubt, this Report does not constitute investment advice, is not intended to be relied upon as investment advice, is not an endorsement of this project or team, and it is not a guarantee as to the absolute security of the project. CD owes no duty to any Third-Party by virtue of publishing these Reports.

PURPOSE OF REPORTS The Reports and the analysis described therein are created solely for Clients and published with their consent. The scope of our review is limited to a review of Solidity code and only the Solidity code we note as being within the scope of our review within this report. The Solidity language itself remains under development and is subject to unknown risks and flaws. The review does not extend to the compiler layer, or any other areas beyond Solidity that could present security risks. Cryptographic tokens are emergent technologies and carry with them high levels of technical risk and uncertainty.

CD makes the Reports available to parties other than the Clients (i.e., “third parties”) – on its website. CD hopes that by making these analyses publicly available, it can help the blockchain ecosystem develop technical best practices in this rapidly evolving area of innovation.

LINKS TO OTHER WEB SITES FROM THIS WEB SITE You may, through hypertext or other computer links, gain access to web sites operated by persons other than ConsenSys and CD. Such hyperlinks are provided for your reference and convenience only, and are the exclusive responsibility of such web sites’ owners. You agree that ConsenSys and CD are not responsible for the content or operation of such Web sites, and that ConsenSys and CD shall have no liability to you or any other person or entity for the use of third party Web sites. Except as described below, a hyperlink from this web Site to another web site does not imply or mean that ConsenSys and CD endorses the content on that Web site or the operator or operations of that site. You are solely responsible for determining the extent to which you may use any content at any other web sites to which you link from the Reports. ConsenSys and CD assumes no responsibility for the use of third party software on the Web Site and shall have no liability whatsoever to any person or entity for the accuracy or completeness of any outcome generated by such software.

TIMELINESS OF CONTENT The content contained in the Reports is current as of the date appearing on the Report and is subject to change without notice. Unless indicated otherwise, by ConsenSys and CD.